This journal entry is made to eliminate the dividends payable that the company has made at the declaration date as well as to recognize the cash outflow that is not an expense. Since accountants at Your Co. have already created the liability (Dividends Payable) and have not yet paid the cash dividend, no accounting financial statement is changed. The declaration date is the date on which the board of directors declares the dividend.

The Journal Entries

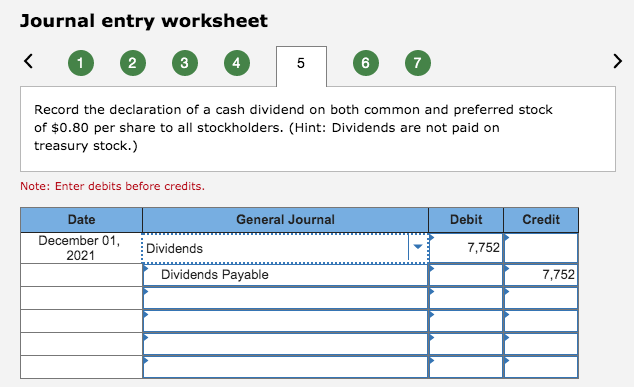

Cash dividends are corporate earnings that companies pass along to their shareholders. First, there must be sufficient cash on hand to fulfill the dividend payment. On the day the board of directors votes to declare a cash dividend, a journal entry is required to record the declaration as a liability.

How confident are you in your long term financial plan?

- However, the statement of cash flows will not show the $250,000 dividend as it has not been paid yet; hence no cash is involved here yet.

- The legality of a dividend generally depends on the amount of retained earnings available for dividends—not on the net income of any one period.

- All of our content is based on objective analysis, and the opinions are our own.

- Corporations experiencing growth generally are more likely to issue a stock dividend than stable, mature firms.

From a theoretical and practical point of view, there must be a positive balance in retained earnings in order to issue a dividend. The dividend payout ratio is the ratio of dividends to net income, and represents the proportion of net income paid out to equity holders. On the date that the board of directors decides to pay a dividend, it will determine the amount to pay and the date on which payment will be made. The major factor to pay the dividend may be sufficient earnings; however, the company needs cash to pay the dividend. Although it is possible to borrow cash to pay the dividend to shareholders, boards of directors probably never want to do that. Corporations experiencing growth generally are more likely to issue a stock dividend than stable, mature firms.

Large stock dividend

When the company makes the dividend payment to the shareholders, it can make the journal entry by debiting the dividends payable account and crediting the cash account. At the date the board of directors declares dividends, the company can make journal entry by debiting dividends declared account and crediting dividends payable account. The number of shares outstanding has increased from the 60,000 shares prior to the distribution, to the 78,000 outstanding shares after the distribution. The difference is the 18,000 additional shares in the stock dividend distribution. No change to the company’s assets occurred; however, the potential subsequent increase in market value of the company’s stock will increase the investor’s perception of the value of the company. A large stock dividend occurs when a distribution of stock to existing shareholders is greater than 25% of the total outstanding shares just before the distribution.

There is no change in total assets, total liabilities, or total stockholders’ equity when a small stock dividend, a large stock dividend, or a stock split occurs. A stock split causes no change in any of the accounts within stockholders’ equity. The impact on the financial statement usually does not drive the decision to choose between one of the stock dividend types or a stock split. Large stock dividends and stock splits are done in an attempt to lower the market price of the stock so that it is more affordable to potential investors.

The amount at which retained earnings is debited depends on the level of stock dividend, i.e. whether is a small stock dividend or a large stock dividend. A cash dividend is the standard form of dividend payout authorized by a corporation’s board of directors. These dividends are typically authorized for payment in cash on either a quarterly or annual basis, though special dividends may also be issued from time to time. It is at that time that the dividend becomes a liability of the corporation and is recorded in its books. Since there are 100,000 common shares outstanding, the total cash dividends will be $120,000.

They are ‘dividends’ in the sense that they represent distribution to shareholders. Companies issue stock dividends when they want to bring down the market price of their common stock. A stock dividend is a type of dividend distribution in which additional shares are distributed to shareholders, usually at no cost. These new shares are then traded on the same exchange at current market prices. If the company prepares a balance sheet prior to distributing the stock dividend, the Common Stock Dividend Distributable account is reported in the equity section of the balance sheet beneath the Common Stock account.

All of our content is based on objective analysis, and the opinions are our own. As this excerpt indicates, the management at General Electric Company has given considerable thought to the amount and timing of dividends. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

The total stockholders’ equity on the company’s balance sheet before and after the split remain the same. A traditional stock split occurs when a company’s board of directors issue new shares to existing shareholders what are marketable securities robinhood in place of the old shares by increasing the number of shares and reducing the par value of each share. For example, in a 2-for-1 stock split, two shares of stock are distributed for each share held by a shareholder.