A consistently rising WASO might indicate a company’s reliance on issuing new shares for funding, possibly diluting existing shareholders’ value. The shares can be grouped according to the length of time that they were outstanding. In this case, group 1 consists of 100,000 shares that were outstanding for the entire year, while groups 2 and 3 are included in the 20,000 shares issued on 1 April. Consequently, the treatment of stock dividends and splits is different from the treatment used for issuances of shares in exchange for assets or services. If the investor holds two shares in the Company, he will now have one share. Treasury stock consists of shares that the company has acquired in a buyback.

How does a stock split affect WASO?

We pro-rated the weighted average number of shares according to their duration. Simply put, the funds generated from issuing new shares were available to the Company for nine months only; hence, these numbers were pro-rated. The weighted average is used by accountants reporting a company’s financial results in accordance with GAAP (Generally Accepted Accounting Principals). A weighted average is a calculation used to give more weight to more influential values within a data set, and lower weight to values with less influence. Enter the number of beginning shares outstanding and select the starting date. Note that the date must fall within the selected beginning and ending dates, and it must be different from any and all other transaction dates.

Stock Splits

Changes occur due to stock issuance, buybacks, or corporate actions like splits. Each affects the share count differently but must be accurately reflected in financial analysis. The trajectory of WASO over time can signal a company’s strategy and financial health.

How weighted average is useful with stocks

The figure for number of outstanding shares does not include any treasury stock. Among investors, it is most relevant to those who compile a position in a stock over a long period of time, buying on the dips and holding the shares. It includes shares held by the general public and restricted shares that are owned by company officers and insiders. We will use 562,500 because, in the above calculation, we assigned weights according to the time proportion that the share outstanding figure was unchanged. For example, the opening figure of 500,000 remained unchanged for 3 months (i.e., 25% of the total time of the year) until the start of the second quarter, after which it changed.

- In other words, the formula takes the number of shares outstanding during each month weighted by the number of months that those shares were outstanding.

- Suppose that Company XYZ Corporation has 500,000 shares at the beginning of its fiscal year.

- The shares can be grouped according to the length of time that they were outstanding.

- Let’s take an example to illustrate how the sale and purchase of common shares impact the company’s weighted average number of shares outstanding.

- Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer.

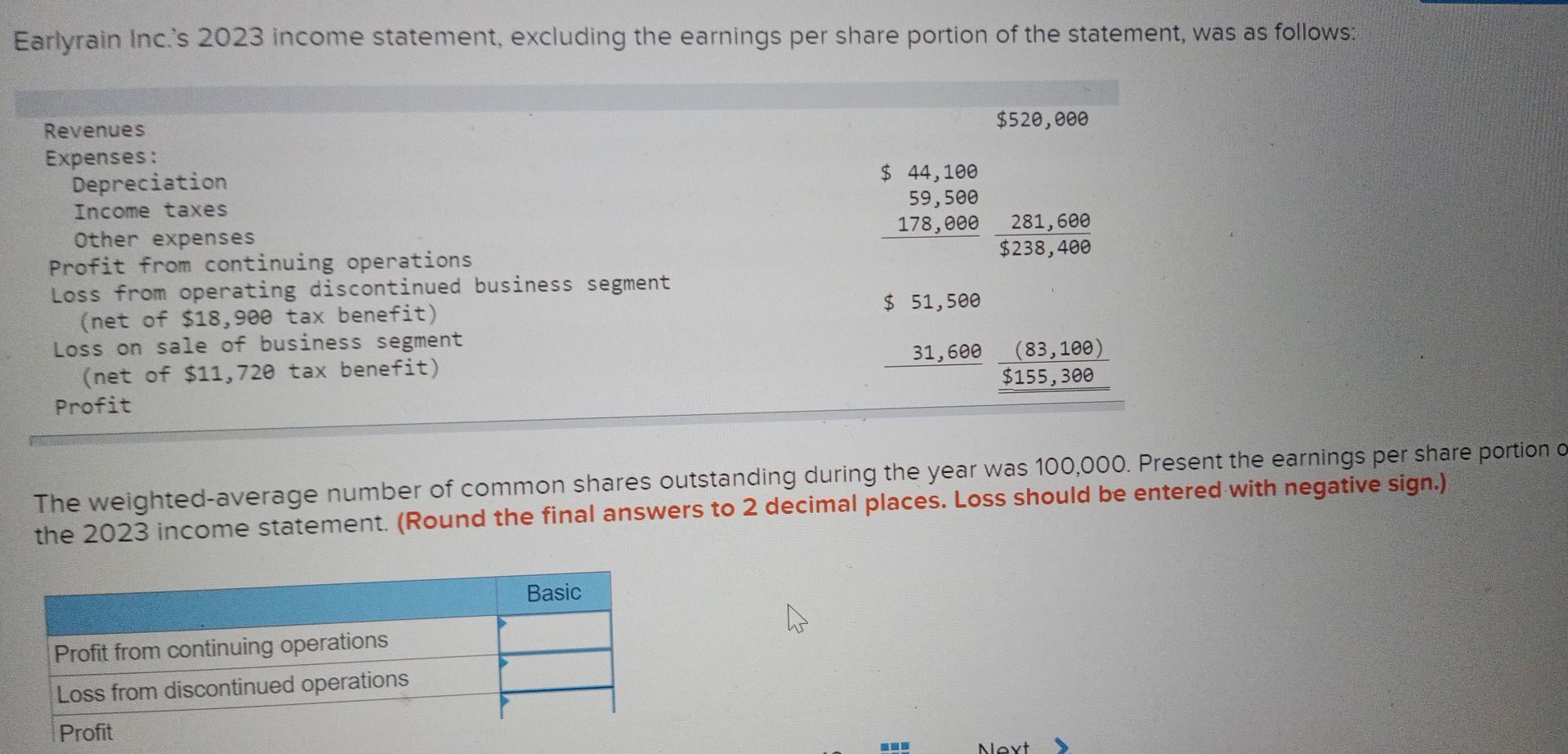

Therefore, all public companies determine the weighted average number of shares outstanding at the end of their reporting period to calculate and report EPS in their financial statements. Let’s take an example to illustrate how the sale and purchase of common shares impact the company’s weighted average number of shares outstanding. The number of shares outstanding can change substantially over the course of a year. For example, the board of directors might elect to buy back a certain number of shares. Or, a holder of the company’s convertible bonds may elect to convert them into common stock.

The earnings per share (EPS) metric, for example, is a method of corporate valuation used by analysts to determine the profitability of a potential investment. It is calculated by dividing the company’s earnings for a given period by the number of common shares outstanding. Assume a company has 150,000 outstanding shares at the beginning of the year but buys back half of them in September, leaving only 75,000 at the end of the year.

Imagine a situation where the company exercises a share buyback at the end of the year. If that figure is taken and used to calculate EPS, then the EPS would be much higher, and it would eventually amount to polishing the financial figures. Select whether the transaction resulted in an increase or a decrease in the total common shares outstanding. The purpose of the repurchase can also be to eliminate the shareholder dilution that will occur from future ESOs or equity grants. Different scenarios for calculating the weighted average of outstanding shares are shown in the following examples.

When the number of outstanding shares is changed by a stock dividend or split, the firm’s earning power is not affected. However, if the year-end share increase were due to a stock split that occurred on December 15th of the year, the 15,000 simple average result would not accurately reflect the day-to-day average for the entire maximizing the higher education tax credits year. It excludes closely held shares, which are stock shares held by company insiders or controlling investors. These types of investors typically include officers, directors, and company foundations. While outstanding shares are a determinant of a stock’s liquidity, the latter is largely dependent on its share float.

The initial number of shares was maintained from January to September, or nine months, meaning there were only 75,000 shares outstanding for the remaining three months of the year. Notice that Alpha Inc. has ignored 25,000 shares issued on December 31 in above computation. The reason is that these shares have been issued on the last day of the year and have not been outstanding during the year 2022. In this case, the same result could have been achieved by multiplying the 111,000 shares from Example 1 by a factor of 2. This shortcut is used to adjust the average outstanding shares for earlier years covered by comparative statements. Of the 40,000 split shares issued on 1 April, group 2 consists of 16,000 considered to have been outstanding from 1 April to 31 December, and group 3 is composed of 24,000 that were outstanding from 1 April to 31 August.

It accounts for the timing of share issuance or repurchase within a financial period. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Group 1 consists of 200,000 split shares that were effectively outstanding for the entire year.