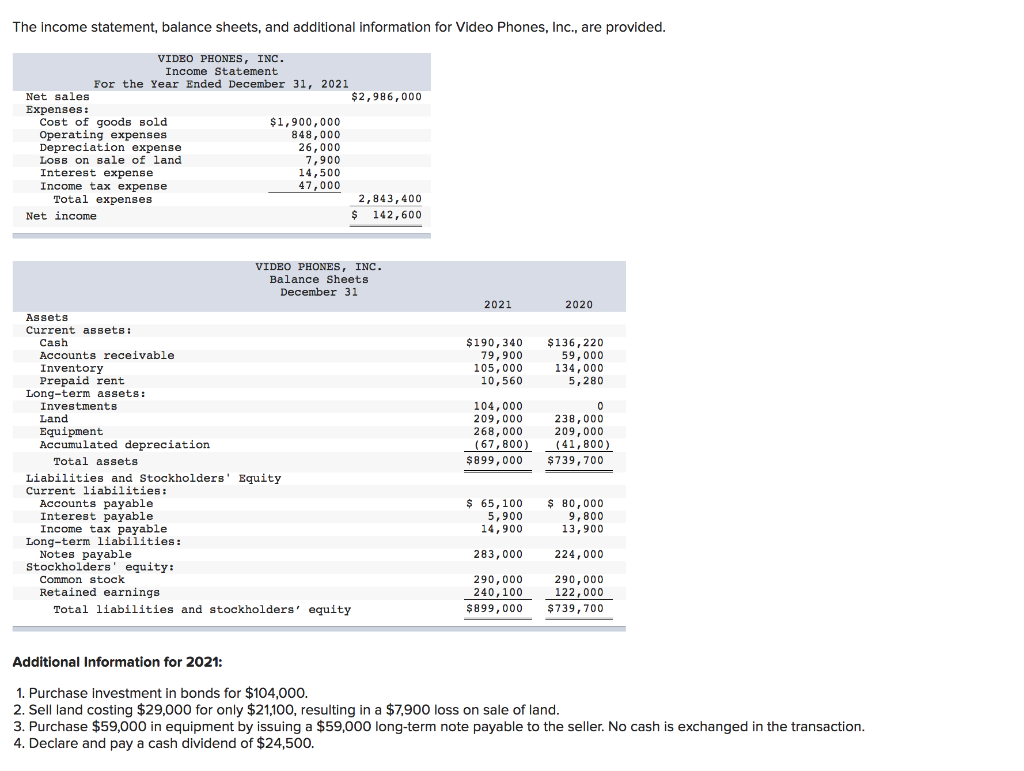

Given that the transaction didn’t involve cash, it would have no effect on the cash flow statement. Both options A and C are cash activities that would be reflected on a company’s cash flow statement. Dive into the complex world of Non Cash Acquisition with this comprehensive study. This exploration will aid in understanding the concept of Non Cash Acquisition and the basics of asset acquisition without cash transactions. You’ll learn about its significance in intermediate accounting, practical techniques and real-world examples.

- Treasury stock arises when the board of directors elects to have a company buy back shares from shareholders.

- Each method offers unique insights and is chosen based on the nature of the asset and the context of the transaction.

- The company comes to the agreement to exchange machine with a piece of land which has a market value of $ 900,000.

- The accounting for cryptocurrency transactions presents unique challenges, including the volatility of digital currency values and the lack of comprehensive regulatory guidance.

- Depreciation and amortization, being non-cash expenses, are added back to net income in the operating activities section.

Hello and welcome to Viewpoint

This discount on common stock is not an expense in the income statement; however, as mentioned above, it is treated as a reduction of par value common stock which is presented in the balance sheet. For example, how to calculate profit margin a cash receipt of $8 per share for common stock of $10 par value. This is due to a lack of interest from investors and there is only one investor is willing to pay $8 per share for 1,000 shares.

Issuing Preferred Stock

The tax implications of non-cash transactions are multifaceted and can significantly influence a company’s tax liability and overall financial strategy. Understanding these implications is essential for effective tax planning and compliance. For instance, barter transactions, while not involving cash, are still considered taxable events. The fair market value of the goods or services exchanged must be reported as income, and corresponding deductions can be claimed for the expenses incurred. This requires meticulous record-keeping and accurate valuation to ensure that the tax filings reflect the true economic value of the transactions. The book value of an asset is not used when issuing common stock for non-cash assets because it reflects the asset’s historical cost minus accumulated depreciation, not its current market value.

Viewpoint allows you to save up to 25 favorites.

The lack of standardized methods for valuing unique assets can lead to disparities in valuation outcomes. The timing of recognizing income or deductions related to noncash transactions can also affect a company’s tax liabilities. The Internal Revenue Service (IRS) typically requires that income be recognized when it is earned, regardless of whether it is received in cash or another form.

These items are taken on the income statement in small increments called depreciation or amortization. Depreciation and amortization are perhaps the two most common examples of expenses that reduce taxable income without impacting cash flow. Companies factor in the deteriorating value of their assets over time in a process known as depreciation for tangibles and amortization for intangibles. In today’s complex financial landscape, non-cash transactions play a pivotal role in shaping the economic activities of businesses.

In addition to activities that generate cash flows (operating, investing, and financing), companies also engage in investing and financing activities that do not generate any cash flows. These activities are therefore not reported on the cash flow statement. Figure 14.5 shows what the equity section of the balance sheet will reflect after the preferred stock is issued. A non-cash acquisition is a process where a company acquires another entity without the explicit exchange of cash. The acquiring company may offer its stocks, bonds, or other assets as form of payment for the takeover.

In the previous article, we covered the cost of comm stock equity calculation. In this article, we cover how to account for the issuance of common stock. This ranges from the journal entry for issuance of common stock of all types from par value stock to no par value stock as well as stock for non-cash assets. The market approach relies on comparable market data to determine an asset’s value.

For instance, a company that heavily relies on stock-based compensation might show lower net income due to the expensing of stock options, even if its cash flow remains robust. This distinction is crucial for investors and analysts who seek to understand the underlying performance of the business beyond mere cash transactions. Stock-based compensation is a prevalent method used by companies to reward employees, particularly in the tech and startup sectors. This form of compensation involves granting employees shares or stock options, aligning their interests with the company’s long-term success. The accounting for stock-based compensation is governed by standards such as ASC 718, which requires companies to measure the fair value of the equity instruments granted. This value is then expensed over the vesting period, impacting the company’s income statement and equity.

Alternatively, in accounting, a non-cash item refers to an expense listed on an income statement, such as capital depreciation, investment gains, or losses, that does not involve a cash payment. In a reverse acquisition, the company issuing stock is typically the larger of the two entities involved. In an acquisition of assets in exchange for stock, both companies are usually of roughly equal size. As an example of a stock transaction, suppose that a company issues 1,000 shares of $5 par common stock to obtain an asset worth around $12,000. Depreciation and amortization, while non-cash expenses, have significant tax implications as well. The Internal Revenue Service (IRS) allows businesses to deduct depreciation expenses, thereby reducing taxable income.