A high Contribution Margin Ratio indicates that each sale produces more profit than it did before and that the business will have an easier time making up fixed costs. A low Contribution Margin Ratio, on the other hand, suggests that there may be difficulty in covering fixed costs and making profits due to lower margins on individual sales. The contribution margin measures how efficiently a company can produce products and maintain low levels of variable costs. It is considered a managerial ratio because companies rarely report margins to the public.

Contribution Margin: What Is It and How To Calculate It

It’s an important metric that compares a company’s overall profit to its sales. However, if you want to know how much each product contributes to your bottom line after covering its variable costs, what you need is a contribution margin. The contribution margin ratio is used by finance professionals to analyze a company’s profitability. It is often used for building a break-even analysis, which helps companies determine at what point a new business project will reach enough sales to cover the costs. Companies often look at the minimum price at which a product could sell to cover basic, fixed expenses of the business. Fixed expenses do not vary with an increase or decrease in production.

Contribution Margin Ratio: What It Is And How To Calculate It

While contribution margin is expressed in a dollar amount, the contribution margin ratio is the value of a company’s sales minus its variable costs, expressed as a percentage of sales. However, the contribution margin ratio won’t paint a complete picture of overall product or company profitability. At a contribution margin ratio of 80%, approximately $0.80 of each sales dollar generated by the sale of a Blue Jay Model is available to cover fixed expenses and contribute to profit.

Operating Profit or Loss

It also helps management understand which products and operations are profitable and which lines or departments need to be discontinued or closed. This means that the production of grapple grommets produce enough revenue to cover the fixed costs and still leave Casey with a profit of $45,000 at the end of the year. Once you’ve calculated your contribution margin, use this number in conjunction with your total fixed expenses for the given time period to calculate net profit or net loss.

Ready to Level Up Your Career?

- Thus, the total manufacturing cost for producing 1000 packets of bread comes out to be as follows.

- For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

- Furthermore, it also gives you an understanding of the amount of profit you can generate after covering your fixed cost.

- Further, it also helps in determining profit generated through selling your products.

To demonstrate this principle, let’s consider the costs and revenues of Hicks Manufacturing, a small company that manufactures and sells birdbaths to specialty retailers. The concept of this equation relies on the difference between fixed and variable costs. Fixed costs are production costs that remain the same as production efforts increase. Variable costs, on the other hand, increase with production levels.

Which of these is most important for your financial advisor to have?

Thus, CM is the variable expense plus profit which will incur if any activity takes place over and above BEP. Suppose Company A has the following income statement with revenue of 100,000, variable costs of 35,000, and fixed costs of 20,000. For variable costs, the company pays $4 to manufacture each unit and $2 labor per unit. From this calculation, ABC Widgets learns that 70% of each product sale is available to contribute toward the $31,000 of total fixed expenses it needs to cover each month and also help achieve its profit target.

The contribution margin income statement separates the fixed and variables costs on the face of the income statement. This highlights the margin and helps bookkeeping test measures knowledge of basic bookkeeping skills illustrate where a company’s expenses. Variable expenses can be compared year over year to establish a trend and show how profits are affected.

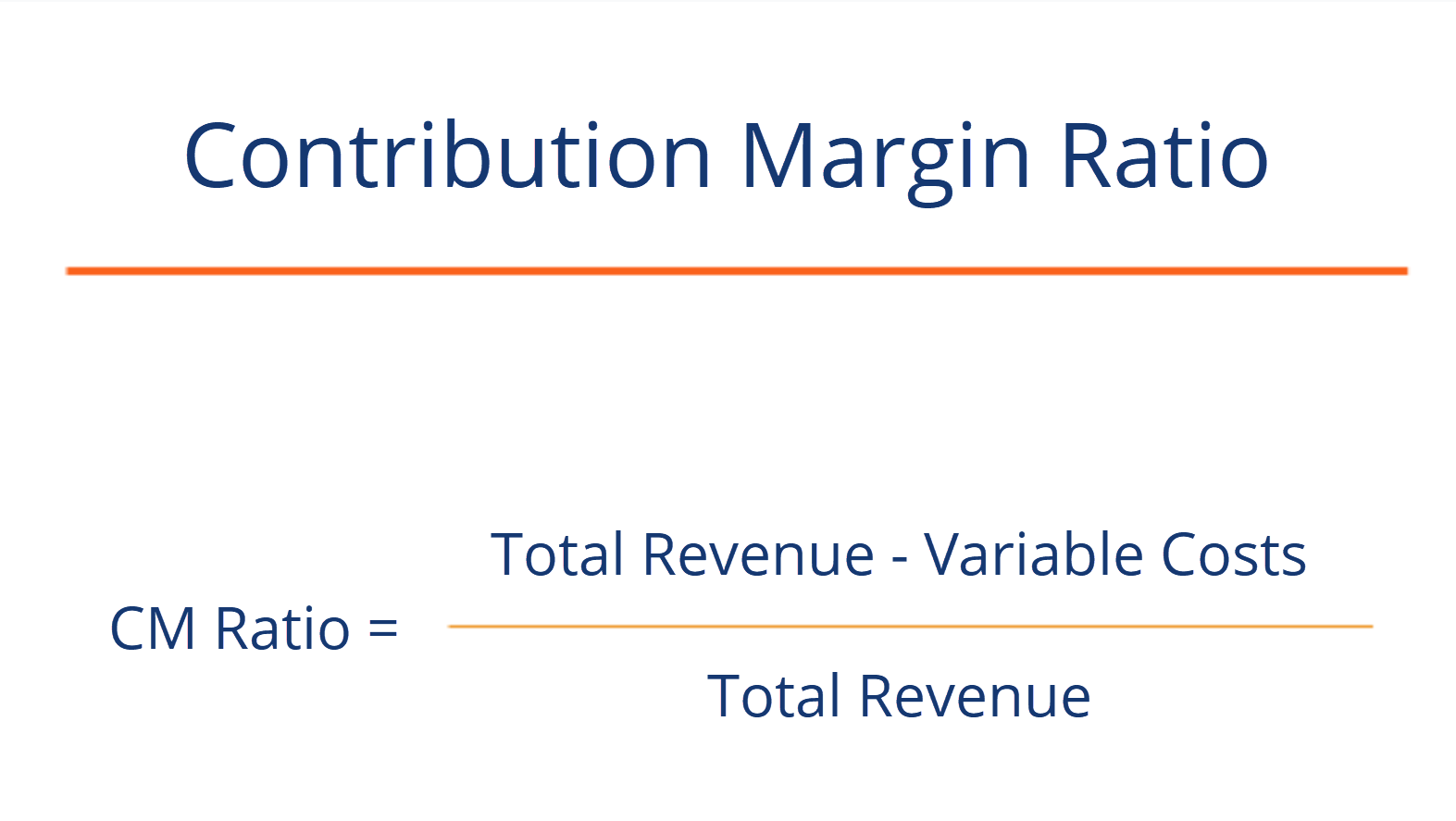

Contribution margin calculation is one of the important methods to evaluate, manage, and plan your company’s profitability. Further, the contribution margin formula provides results that help you in taking short-term decisions. Suppose you’re tasked with calculating the contribution margin ratio of a company’s product. The formula to calculate the contribution margin ratio (or CM ratio) is as follows. Alternatively, the company can also try finding ways to improve revenues. However, this strategy could ultimately backfire, and hurt profits if customers are unwilling to pay the higher price.

In May, 750 of the Blue Jay models were sold as shown on the contribution margin income statement. When comparing the two statements, take note of what changed and what remained the same from April to May. The addition of $1 per item of variable cost lowered the contribution margin ratio by a whopping 10%. You can see how much costs can affect profits for a company, and why it is important to keep costs low.

The first step to calculate the contribution margin is to determine the net sales of your business. Net sales refer to the total revenue your business generates as a result of selling its goods or services. That is, fixed costs remain unaffected even if there is no production during a particular period.

This resulting margin indicates the amount of money available with your business to pay for its fixed expenses and earn profit. In other words, contribution margin per unit is the amount of money that each unit of your product generates to pay for the fixed cost. Accordingly, the contribution margin per unit formula is calculated by deducting the per unit variable cost of your product from its per unit selling price. However, this implies that a company has zero variable costs, which is not realistic for most industries. As such, companies should aim to have the highest contribution margin ratio possible, as this gives them a higher likelihood of covering its fixed costs with the money remaining to reach profitability. Once you have calculated the total variable cost, the next step is to calculate the contribution margin.